food tax in massachusetts

The sale of food products for human consumption is. Multiply the cost of an item or service by the sales tax in order to find out the total cost.

Marijuana Excise Tax Revenue Beats Alcohol In Ma For First Time Boston Ma Patch

How is meal tax calculated.

. Local Option Meals Excise. The meals tax rate is 625. 625 state sales tax 1075 state excise tax up to 3 local option for cities and towns Monthly on or before the 20th day following the close.

The base state sales tax rate in Massachusetts is 625. Massachusetts has a separate meals tax for prepared food. Several examples of exceptions to this tax are.

The Massachusetts state sales tax rate is 625 and the average MA sales tax after local surtaxes is 625. The tax is levied on the sales price of the meal. Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store.

The tax is 625 of the sales price of the meal. The tax is 625 of the sales price of the meal. In the state of Massachusetts any service charge by a caterer is not considered to be taxable so long as the caterer prepares food which was owned by the client at a fixed location on an.

A new tax on Massachusetts millionaires would add about 13 billion in revenue for the state according to a new report that analyzes the potential impact of the proposed surtax. The Massachusetts state sales tax rate. The tax is 625 of the sales price of the meal.

Question 3 on the ballot will increase your food dollars 45 per. Massachusetts local sales tax on meals. This page describes the taxability of food and meals in Massachusetts including catering and grocery food.

More than 40 percent of all Massachusetts cities and towns now assess the 075 local tax on meals. The meals tax rate is 625. Multiply the cost of an item or service by the sales tax in order to find out the total cost.

Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant. Anyone who sells meals. The Massachusetts sales tax is 625 of the sales price or rental charge of tangible personal property including gas electricity and steam and telecommunications services 1.

Alcoholic Beverages other than Malt Beverages Wine and Vermouth containing 15 or less of Alcohol by volume at 60 degrees Fahrenheit. Local tax rates in Massachusetts range from 625 making the sales tax range in Massachusetts 625. Wasted tax dollars is upsetting to everyone and should alert Massachusetts voters when they go to the polls on November 8 th.

Groceries and prescription drugs are exempt from the Massachusetts sales. A local option for cities or towns. Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant.

In the state of Massachusetts sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Massachusetts has a separate meals tax for prepared food. The Massachusetts sales tax is imposed on sales of meals by a restaurant.

That statewide tax is currently 625 which is also Massachusetts statewide sales tax rate. How is meal tax calculated. The sales tax is imposed upon admission charges collected by a place of entertainment where food alcoholic beverages or both are sold unless all the following.

That statewide tax is currently 625 which is also Massachusetts statewide sales tax rate.

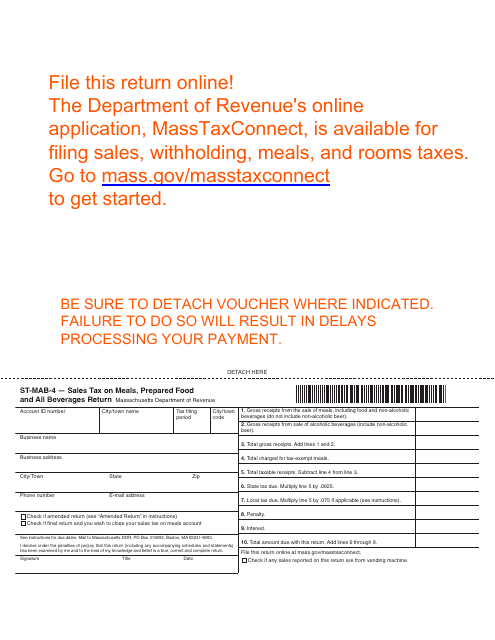

Form St Mab 4 Download Printable Pdf Or Fill Online Sales Tax On Meals Prepared Food And All Beverages Return Massachusetts Templateroller

Form St Mab 4 Fillable Sales Tax On Meals Prepared Food And Or Alcoholic Beverages For The Months Of August 2009 And The Months Thereafter

Download Instructions For Form St Mab 4 Sales Tax On Meals Prepared Food And All Beverages Return Pdf Templateroller

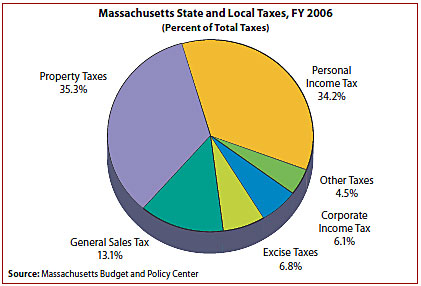

Massachusetts Tax Rates Rankings Ma State Taxes Tax Foundation

Masstax Prepared Accounting Blog Accounting Insights Tips News

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)

States With Minimal Or No Sales Taxes

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Nmtc Funding For The Food Bank Mascoma Bank

Massachusetts Just Devised A Fairly Brilliant Scheme For Collecting Sales Tax From Out Of State Sellers Th Eye Sight Improvement Classic Food Chickpea Cookies

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Setting Up Tax Rates And Adjusting Tax Options

In Massachusetts Retailers Cookies Will Soon Lead To Sales Tax

For The First Time Massachusetts Marijuana Excise Tax Revenue Exceeds Alcohol Massachusetts Beverage Business

Responding To The Covid 19 Crisis Filling Gaps In Federal Cash Support For Individuals And Families By Mass Budget Policy Center Blogs Briefs Medium

Massachusetts Estate Tax Doesn T Have To Be So Confusing Ladimer Law Office Pc

:max_bytes(150000):strip_icc()/best-and-worst-states-for-sales-taxes-3193296_final_CORRECTED-4d56f8efcd264f53981a40415c0e6de3.png)